54+ does applying for a mortgage affect your credit score

Web A mortgage loan is similar with certain elements playing a major role in the approval process. Web The Bottom Line.

Large Investors In Peerberry Are Growing The Most Peer To Peer Lending Marketplace Peerberry

Of course you need to check with the.

. Ad Easier Qualification And Low Rates With Government Backed Security. Web Your credit score also affects your pricing for mortgage insurance which is required if you make a down payment less than 20. But youll notice that new credit including mortgage applications for pre-approval only accounts for.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Once you have the mortgage however it can affect your credit. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it.

Ad Home Loans Low APR Top Lenders Comparison Free Online Offers. Web Your credit score is only one component of your mortgage lenders decision but its an important one. Web A mortgage account will affect your credit score for as long as it appears on your credit report.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web Credit dings are pretty much inevitable when you apply for a new credit account open a loan or close one. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Web This is called a hard inquiry because it can actually affect your score. Web If you keep a close eye on your credit score you might notice that it drops shortly after you apply for a loan. For most people a mortgage is the largest debt they have on their credit report.

That can happen because of a hard inquiry or lenders checking. Web Your length of credit history makes up 15 of your credit score and includes the age of your oldest credit account your newest account and the average. All You Need to Take the Best Home Loan For You.

Following our guidelines about not. Web A mortgage pre-approval affects a home buyers credit score. Web Closing a mortgage has very little impact on your credit score unlike closing a revolving credit card which can hurt your score by reducing your available.

Easily Compare Lenders Apply Today. Web Student loans can affect your financial standing with a lender in two main ways. First your credit score will take a hit if you miss payments.

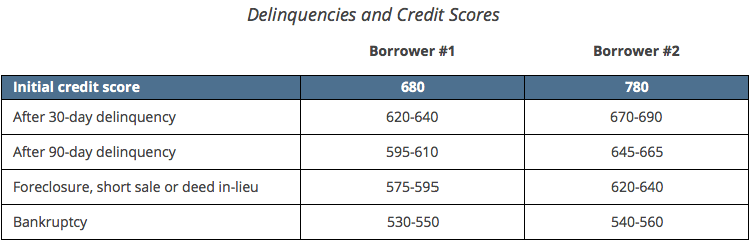

The pre-approval typically requires a hard credit inquiry which decreases a buyers credit score. Web Assuming nothing in a mortgage application changes except the credit score someone with a score in the 680-699 range would have a mortgage rate. Credit report Credit history with.

Applying for other lines of credit car loans credit. Web First when you apply for a mortgage loan lenders will make whats called a hard inquiry A hard inquiry means that the lender pulls your entire report and scores. Apply Get Pre-Approved Today.

Web A mortgage calculator can show you the impact of different rates on your monthly payment. See Our Comparison Site Find Out Which Lender Suits You The Best. Mortgage refinancing can indeed affect your FICO score for the worse so its wise to take some precautions.

Ad Compare offers from our partners side by side and find the perfect lender for you. While your DTI can help determine whether or not youll qualify for a mortgage at all your credit score will affect how much youll pay. Thats because a higher credit score can lower.

If your spouses score is above that number you should be fine. The usual mortgage credit score is 670. Explore what factors can affect getting a mortgage and how to.

Ad Compare the Best Home Loans for March 2023. Web Applying for a mortgage with multiple lenders wont hurt your credit score nearly as much as these things will. Ad See what your estimated monthly payment would be with the VA Loan.

Skip The Bank Save. Web Even applying can affect your credit score as an inquiry is placed on your report every time you apply for new credit and stays there for two years. Your ability to obtain and maintain new credit 10 of your credit score This last factor called new credit is the one that can be affected by applying for new loans.

Web 7554 -018 -024 Gold.

What Credit Score Is Needed To Buy A Home

Housing Market Goes Nuts Everyone Sees It But It Can T Last Wolf Street

What To Do If Credit Score Is Not Good For A Mortgage Mybanktracker

How Getting And Paying A Mortgage Affects Your Credit Bankrate

High Resolution Native Mass Spectrometry Chemical Reviews

Bnpl Unicorns That Are Changing The Fintech Industry

How Does A Mortgage Application Affect Your Credit Score

Does A Mortgage Hurt Your Credit Score Experian

Tennessee Pool Loans Swimming Pool Financing Options In Memphis Tn Finance Swimming Pool Construction Near Me

Does Getting Turned Down For A Mortgage Affect Your Credit Score Budgeting Money The Nest

Learn Vest Financial Confidence Curve

How Applying For A Mortgage Will Affect Your Credit Score

How Does A Mortgage Affect Your Credit Score Nerdwallet

How Applying For A Mortgage Will Affect Your Credit Score

How Mortgage Applications Affect Your Credit Score The Mortgage Hut

How Does A Mortgage Affect Your Credit Score Nerdwallet

:max_bytes(150000):strip_icc()/178866223-5bfc3927c9e77c005147a91c.jpg)

How Your Mortgage Affects Your Credit Score